Owner Relations

Denbury’s royalty interest owners play a vital role in our operations. We are committed to providing owners with transparent information and high quality service.

Owner Relations Online System

Welcome to our Owner Relations Online System. Once logged in, you will be able to:

- View and manage your account information

- View royalty check details

- Enroll in Direct Deposit

- Access your 1099s

If you have issues registering or logging into your account, please contact EnergyLink. For all other inquiries, please see our FAQs below or contact our Owner Relations Team.

Forms

Download Denbury Owner Relations forms in PDF format using the links below.

Frequently Asked Questions

A Division Order is a document that lets you know production from a well has started and Denbury is preparing to make distribution of revenue derived from the sale of oil, gas and other hydrocarbons. Denbury uses Division Orders to verify that your name and address are correct as shown for mailing payments, and to verify your decimal is accurate, to ensure revenue distribution is correct.

Form W-9 is a form used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service. It requests the name, address, and taxpayer identification information of a taxpayer. W-9 forms are required by federal law in order for Denbury to pay royalties to Interest Owners. Please click here to complete your W-9. Please note this document must have your signature to be valid. Therefore, you will need to print it out, complete it and either mail by post, or scan and email or fax.

Royalty interest refers to ownership of a portion of a resource or the revenue it produces. Denbury Royalty Interest (“RI”) owners own minerals and have signed an oil and gas lease which entitles the owner to a percentage of revenue from the sale of oil and gas produced from the acreage described in the oil and gas lease. This percentage of revenue is referred to as the “royalty interest.” This interest is not subject to any of the costs related to the development, drilling, operations or maintenance of the well.

A Working Interest (“WI”) is a percentage of ownership in an oil and gas lease and grants its owner the right to explore, drill, and produce oil and gas from a tract of property. Working Interest owners are obligated to pay their proportionate percentage of the cost of leasing, drilling, producing and operating a well or unit.

A Mineral Interest (“MI”) is also known as an unleased mineral interest and is a cost-bearing interest because the unleased mineral interest owners are not sharing a portion of their production in exchange for the Operators covering all of the production costs associated with extracting the resources from the ground. Unleased mineral interest owners are entitled to 100% of their production minus their proportionate share of the cost of drilling, completing and equipping the well in addition to operating costs after the well is completed.

A net proceeds interest is not an interest in actual minerals. Rather, it is a fractional ownership in the revenue derived from the sale of oil and gas, less expenses. This interest type is generally created when the leasehold, or working interest, is transferred through a 24/7 Operating Agreement to a second party, with the first party reserving a percentage of revenue from the sale of production, less expenses.

Although your check detail indicates your interest is a royalty interest (“RI”), as though you own leased minerals, you actually own a net proceeds interest.

An Overriding Royalty Interest (“ORRI”) is an interest which is not connected to an ownership of minerals under the ground. It is the right to receive revenue from the production of oil and gas from a well. The overriding royalty is carved out of the Lessee’s (operator’s) working interest and entitles its owner to a fraction of production. It is limited in duration to the terms of a specific existing oil and gas lease, but is not subject to any of the expenses of development, operation or maintenance. An overriding royalty interest expires once the lease has expired and production has stopped, whereas minerals and royalty owners maintain their ownership after production stops.

Denbury cannot provide an appraisal as the value is a matter of opinion. You may contact a royalty broker or local banker in the county/parish where your lease is located.

All states have laws that require the reporting of unclaimed funds belonging to owners who cannot be located. Please contact the applicable state(s) to reclaim funds that have been escheated and belong to you. A website you may find helpful is the National Association of Unclaimed Property Administrators.

All changes of ownership must be filed on record in the County/Parish/State where the property is located. We cannot provide forms for conveying real property interests. Please contact an attorney for assistance in document selection and preparation.

Contact EnergyLink.

Contact Denbury Owner Relations at 800-348-9030 or by email at ownerrelations@denbury.com.

Address changes must be submitted in writing with all of the following: Name, Old and New Address, Owner Number, and Signature. The preferred method for changing your address is to complete the Owner Change of Address form and either print and mail or fax it, or scan and email it to Owner Relations.

Send your completed Owner Change of Address form to:

Denbury Inc.

Owner Relations

PO Box 251289

Plano, TX 75025

Fax: (972) 673-2430

Phone: (800) 348-9030

ownerrelations@denbury.com

No, address changes must be submitted in writing. The Address Change form may be found here.

Individual

Requests for individuals must be submitted in writing by fax or mail and must be signed. Furnish a copy of the legal document showing the change (Copy of Marriage Certificate, Divorce Decree reinstating maiden name, or other document affecting name change).

Corporation

Requests for corporations must be submitted in writing by fax or mail and must be signed. Furnish a copy of the legal document showing the change (Certificate of Name Change with verification of tax ID to be used or Certificate of Merger with verification of tax ID to be used).

To add a spouse to your account, provide a copy of the conveyance document, properly recorded in the country/parish where your mineral interest is located, to Denbury Owner Relations.

Online account access is provided by EnergyLink. To register, please go to: EnergyLink – User Signup. Please have the following information available to create your account.

1. Operator Name

2. Owner Number

3. Check Amount

4. Check Date

5. Check number

If you have issues registering, please contact EnergyLink – Contact Us.

If your check is not received within 15 business days of the normal payment date, please contact Denbury Owner Relations to reissue the check. Funds are normally reissued with your next check. Please understand that if you ask for a replacement check, the original check will be immediately voided. This means that if the original check arrives on the next day, you should NOT CASH it, as this check will not be honored by Denbury.

Please see the check detail example for more information on understanding your check.

This column includes, but is not limited to, costs associated with gathering, transporting, dehydrating, and processing oil and gas.

Occasionally, adjustments must be made on revenue previously paid to you. When this occurs, the original payment is reversed and the new amount is paid. These negative amounts must be subtracted when calculating your total. These adjustments become necessary for various reasons such as: we were originally provided incorrect production figures (volumes) or pricing from the transporter or gatherer of production and a correction is required; production may be allocated incorrectly and must be corrected; or a tax rate may have changed. We make every effort to properly account for the volume and price in accordance with your lease agreement and state statutes. When a correction is necessary, it could result in a negative or positive effect on your check.

Royalty checks are mailed on the 26th of the month, unless that day is a weekend or a holiday. In that case, payment will be mailed on the following business day.

PLEASE ALLOW 15 BUSINESS DAYS FOR DELIVERY OF YOUR CHECK.

Royalty checks are mailed on the 26th of the month, unless that day is a weekend or a holiday. In that case, payment will be mailed on the following business day.

PLEASE ALLOW 15 BUSINESS DAYS FOR DELIVERY OF YOUR CHECK.

To enroll in, change or cancel your direct deposit, log into your online EnergyLink account. From the Invoices/Checks tab, select the “DD/ACH Enroll” option from the ‘More’ dropdown. If you do not have an online account, you can register at: EnergyLink – User Signup. If you have direct deposit or registration issues, please contact EnergyLink – Contact Us.

Many factors can impact your payment: non-resident tax laws, rounding, decimal of interest or owners may be set up with different check limits. For more information, please contact Denbury Owner Relations for further details.

Payments will be made monthly to all owners with cumulative balances of $50 or more. Balances less than $50 will be released once a year, typically in the Spring.

Payment is made as soon as complete title information is received, but no later than the terms of the lease or state statutes allow.

Yes, upon your request we will obtain a copy and send it to you either by fax or mail.

Check amounts may vary from month to month depending on production volumes, price of product, marketing arrangements, changes in tax laws, or any adjustments that may occur.

Interest is transferred with the appropriate Conveyance for your interest type. Denbury requires transfer documents to be recorded in the county/parish/state in which the property is located. lease contact an attorney for assistance in document selection and preparation.

Please mail a copy of the recorded document to:

P.O. Box 251289

Plano, TX 75025-1289

Attn: Owner Relations

Note: Originals will not be returned

Transfers due to death vary by state. Please contact us directly and we will be happy to assist you.

Provide a copy of the trust agreement or memorandum of trust, in addition to a conveyance document from the current owner of record into the trust. These documents must be recorded in the county/parish and state where the minerals reside and mailed to:

Denbury Inc.

Attn: Owner Relations

P.O. Box 251289

Plano, TX 75025-1289

Provide a copy of the applicable portion of the trust document that identifies the successor trustee, the duties and power of the trustee, and the circumstances leading to the replacement of the trustee. Please inform us if there is a change of address. Mail these documents to:

Denbury Inc.

Attn: Owner Relations

PO box 251289

Plano TX 75025-1289

Note: Originals will not be returned

1099 forms are required by law to be mailed out by January 31st. 1099 forms are also available online by logging into your Online Account. If you do not have an online account set up, please contact Enverus at 1-844-608-2255 or ormssupport@enverus.com. Please be prepared to provide your owner number(s).

The amount required by the IRS to be reported on the 1099 misc. form is the gross amount of your checks (before taxes or other deductions). Your 1099 gross amount should agree with the year to date (YTD) totals on your last check for the year.

If you have multiple tax identification numbers, you will receive a form 1099 for each tax identification number.

Please ensure we have your current address and social security number. Forms to correct either of these are available here. 1099s are issued to royalty owners who have received a gross amount of $10.00 or greater during the tax year, and to working interest owners who received $600.00 or greater during the tax year. Entities identified as corporations are generally not issued a 1099.

Please notify Owner Relations of any discrepancies as soon as possible after receiving your 1099, to ensure your information is corrected prior to submitting the information to the IRS. Changes will be made upon our receipt of the required documentation. The deadline for submitting changes is March 15th of the current year.

Denbury Inc. cannot provide tax advice. Please contact your tax advisor regarding questions concerning your tax return.

You can access a copy of your 1099 through your online account. If you do not have an online account, you can register at: EnergyLink – User Signup

If you have issues registering, please contact: EnergyLink – Contact Us

If you have issues accessing your 1099 online, please contact owner relations at ownerrelations@denbury.com.

To enroll in direct deposit, log into your online EnergyLink account. From the Invoices/Checks tab, select the “DD/ACH Enroll” option from the ‘More’ dropdown. If you do not have an online account, you can register at: EnergyLink – User Signup. If you have direct deposit or registration issues, please contact EnergyLink – Contact Us.

The enrollment process may take up to 90 days.

Yes, if ownership is held jointly all parties are required to sign.

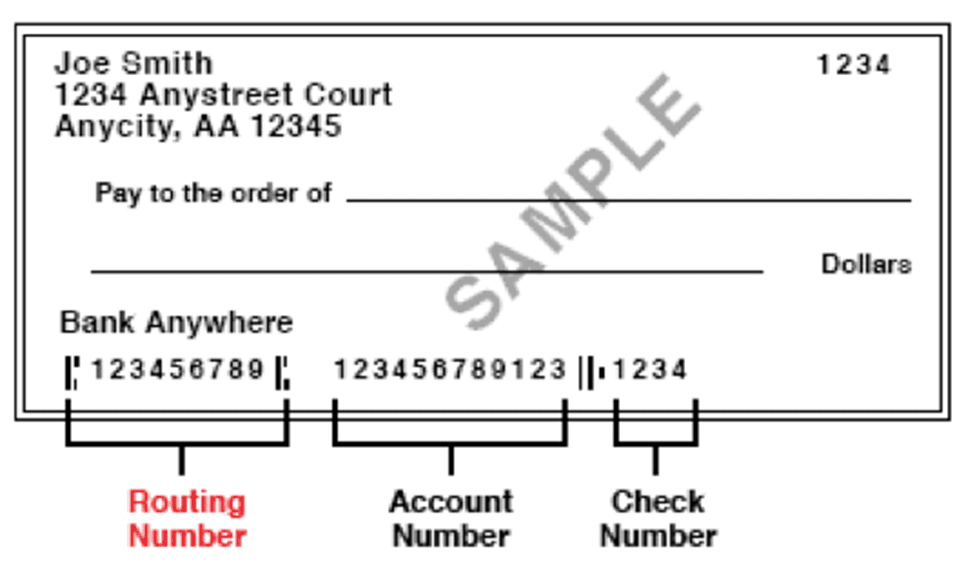

You may request a letter from your bank. It must be on bank letterhead listing the account name, account number and routing number.

No, not at this time.

To change your existing direct deposit banking information, log into your online EnergyLink account. From the Invoices/Checks tab, select the “DD/ACH Enroll” option from the ‘More’ dropdown. If you do not have an online account, you can register at: EnergyLink – User Signup. If you have direct deposit or registration issues, please contact EnergyLink – Contact Us.

The routing number and bank account number is found on the bottom line of the check.

Login to your EnergyLink account, and go to Admin > My Account > click hyperlink “Change My Password”.

Login to your EnergyLink account, and go to Admin > My Account > then update the email and click Update.

To cancel your existing direct deposit banking information, log into your online EnergyLink account. From the Invoices/Checks tab, select the “DD/ACH Enroll” option from the ‘More’ dropdown. If you do not have an online account, you can register at: EnergyLink – User Signup. If you have direct deposit or registration issues, please contact EnergyLink – Contact Us.

You will continue to receive a paper check via USPS Mail.